|

March 13, 2009 |

i-CABLE COMMUNICATIONS LIMITED

Stock Code: 1097

2008 Final Results Announcement

Results Highlights

- Turnover decreased by 10% to HK$2,080 million (2007: HK$2,304 million).

- Net loss before tax was HK$96 million (2007 net profit before tax: HK$199 million).

- Net loss after tax was HK$111 million (2007 net profit after tax: HK$183 million).

- Net cash of HK$690 million as at December 31, 2008 (2007: HK$642 million).

Pay TV

- Subscribers increased by 4% to 917,000 (2007: 882,000).

- Turnover decreased by 15% to HK$1,355 million (2007: HK$1,595 million).

- Operating profit was HK$6 million (2007: HK$179 million).

Internet & Multimedia

- Broadband subscribers decreased by 13% to 267,000 (2007: 306,000).

- Turnover decreased by 2% to HK$576 million (2007: HK$588 million).

- Operating profit decreased by 18% to HK$148 million (2007: HK$180 million).

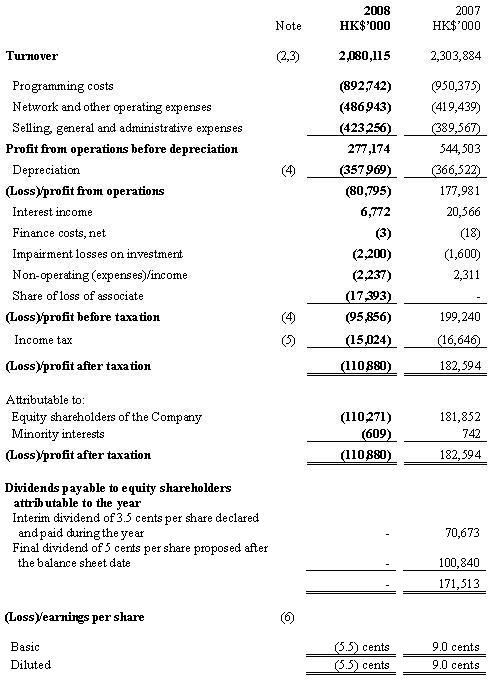

GROUP RESULTS

Group loss attributable to Shareholders for the year ended December 31, 2008 amounted to HK$110 million (2007 group profit attributable to Shareholders: HK$182 million). Basic and diluted loss per share were both 5.5 cents (2007 earnings per share: 9.0 cents).

DIVIDENDS

The Board has resolved not to declare any final dividend for the year ended December 31, 2008.

MANAGEMENT DISCUSSION AND ANALYSIS

A. Review of 2008 Results

Consolidated turnover was 10% lower year-on-year to HK$2,080 million.

Operating costs before depreciation increased by 2% to HK$1,803 million. Network and other operating costs increased by 16% to HK$487 million, selling, general and administrative expenses increased by 9% to HK$423 million, while programming costs were 6% lower to HK$893 million.

Earnings before interest, tax, depreciation and amortisation ("EBITDA") decreased by 49% to HK$277 million.

During the year, the Group accelerated depreciation on set-top-boxes to be replaced in 2009 upon the launch of the next generation transmission encryption system and provided losses from film investments.

Loss after tax was HK$111 million compared with a profit after tax of HK$183 million in 2007.

Basic and diluted loss per share were 5.5 cents as compared to earnings per share of 9.0 cents in 2007.

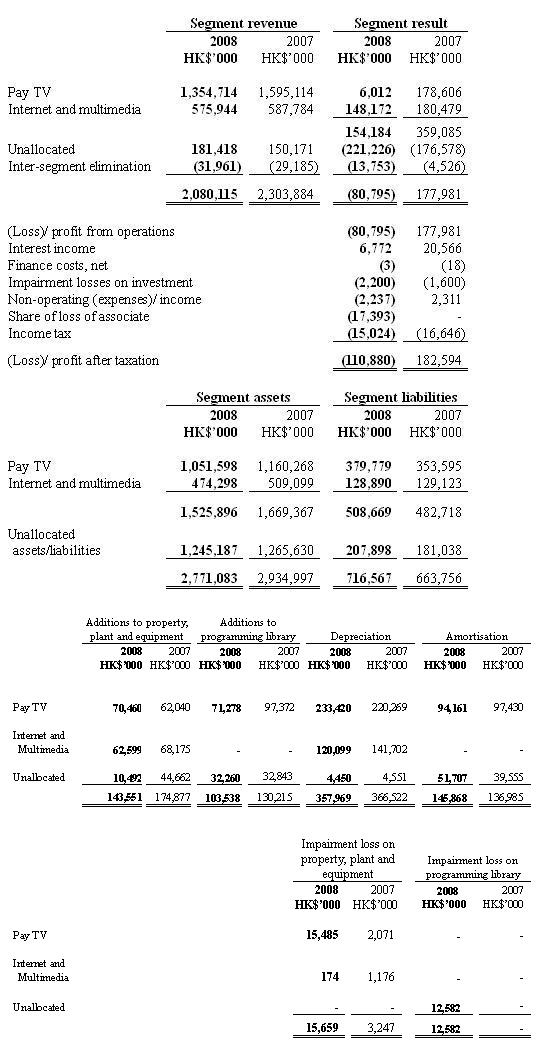

B. Segmental Information

Pay TV

Subscribers were 4% higher year-on-year to 917,000. Turnover decreased by 15% to HK$1,355 million. Operating costs after depreciation decreased by 5% to HK$1,349 million primarily due to lower programming costs. Operating profit was HK$6 million (2007: HK$179 million).

Internet & Multimedia

Broadband subscribers were 13% lower year-on-year to 267,000 and the Voice conveyance service was 6% lower to 149,000 lines. Turnover decreased by 2% to HK$576 million. Operating costs after depreciation increased by 5% to HK$428 million primarily due to costs associated with 2008 Beijing Olympics. Operating profit decreased by 18% to HK$148 million.

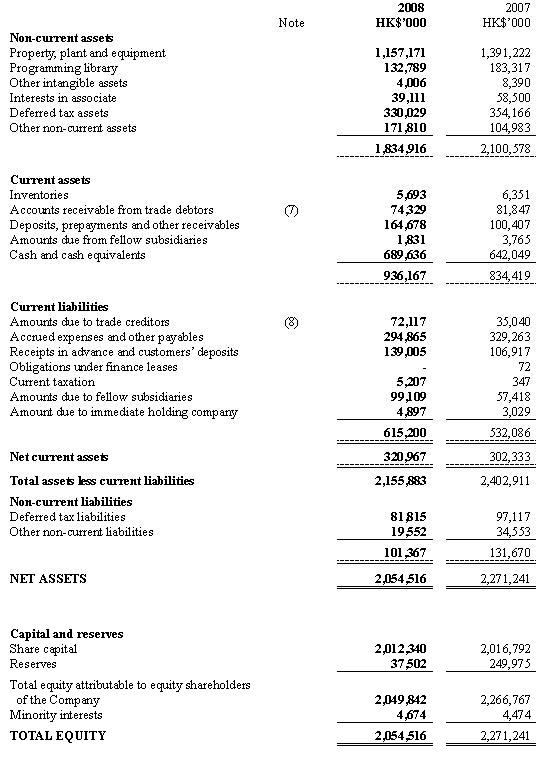

C. Liquidity and Financial Resources

As of December 31, 2008, the Group had net cash of HK$690 million, as compared to HK$642 million a year ago.

The consolidated net asset value of the Group as at December 31, 2008 was HK$2,055 million, or HK$1 per share.

The Group's assets, liabilities, revenues and expenses were mainly denominated in Hong Kong dollars or U.S. dollars and the exchange rate between these two currencies has remained pegged.

Capital expenditure during the year amounted to HK$144 million as compared to HK$175 million last year. Major items included network upgrade and expansion, TV production facilities as well as Internet & Multimedia equipment.

The Group is comfortable with its present financial and liquidity position. Further capital expenditure and new business development will be funded by cash to be generated from operations and, if needed, bank borrowings or other external sources of funds. The Group also had total short-term bank credit facilities of approximately HK$32 million which remained unutilised as of December 31, 2008.

D. Contingent Liabilities

At December 31, 2008, there were contingent liabilities in respect of guarantees, indemnities and letters of awareness given by the Company on behalf of subsidiaries relating to overdraft and guarantee facilities provided by banks up to HK$118 million, of which HK$86 million had been utilised by the subsidiaries.

E. Human Resources

The Group had a total of 2,906 employees at the end of 2008 (2007: 2,907). Total gross amount of salaries and related costs incurred in the corresponding period amounted to HK$739 million (2007: HK$736 million).

With pay for performance culture, we nurture a team of professionals and inspired talents.

The Group has always strived to contribute to the local communities. Being one of the Caring Companies, we were awarded the "Caring Company Scheme 5 Years Plus Logo" by the Hong Kong Council of Social Service in recognition of our continuous commitment in corporate social responsibility.

F. Operating Environment and Competition

Within the Pay TV market, competition remained intense. Our main competitor has been following our lead to launch local channels that focus on news and entertainment in order to chip away at our leadership in these areas. The Group will continue to invest to solidify our edge.

With the markets becoming saturated, it is a war of attrition for both broadcasting and telecommunications services with the players trying to poach subscribers from one another via aggressive pricing, enhanced content and service quality. But the Group's strong balance sheet and low cost base will put us in a good position to stay competitive in a harsh environment.

G. Outlook

Though sustaining minor bruises, the Group has withstood the first wave of the financial tsunami on relatively sound financial position. The operating environment, for the year to come is, however, expected to remain bleak under the prevailing macro-economic climate.

But we have braced for subsequent waves by better equipping ourselves. The Group has acquired premier and attractive contents; is building up a new defence system against piracy; and gearing up for delivering new services such as High Definition TV.

These initiatives will gradually take effect from the second half of the year, and will be supplemented by bold marketing and promotion plans. By building these blocks on our already sound fundamentals, it is hoped that we could be back on a recovery track when the economy turns around.

CODE ON CORPORATE GOVERNANCE PRACTICES

During the financial year under review, all the code provisions set out in the Code on Corporate Governance Practices contained in Appendix 14 of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the "Stock Exchange") were met by the Company, except in respect of one code provision providing for the roles of chairman and chief executive officer to be performed by different individuals. The deviation is deemed necessary as, given the nature and size of the Company's business, it is at this stage considered to be more efficient to have one single person to hold both positions. The Board of Directors believes that the balance of power and authority is adequately ensured by the operations of the Board which comprises experienced and high calibre individuals with a substantial proportion thereof being independent Non-executive Directors.

CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the year ended December 31, 2008

Consolidated Balance Sheet

At December 31, 2008

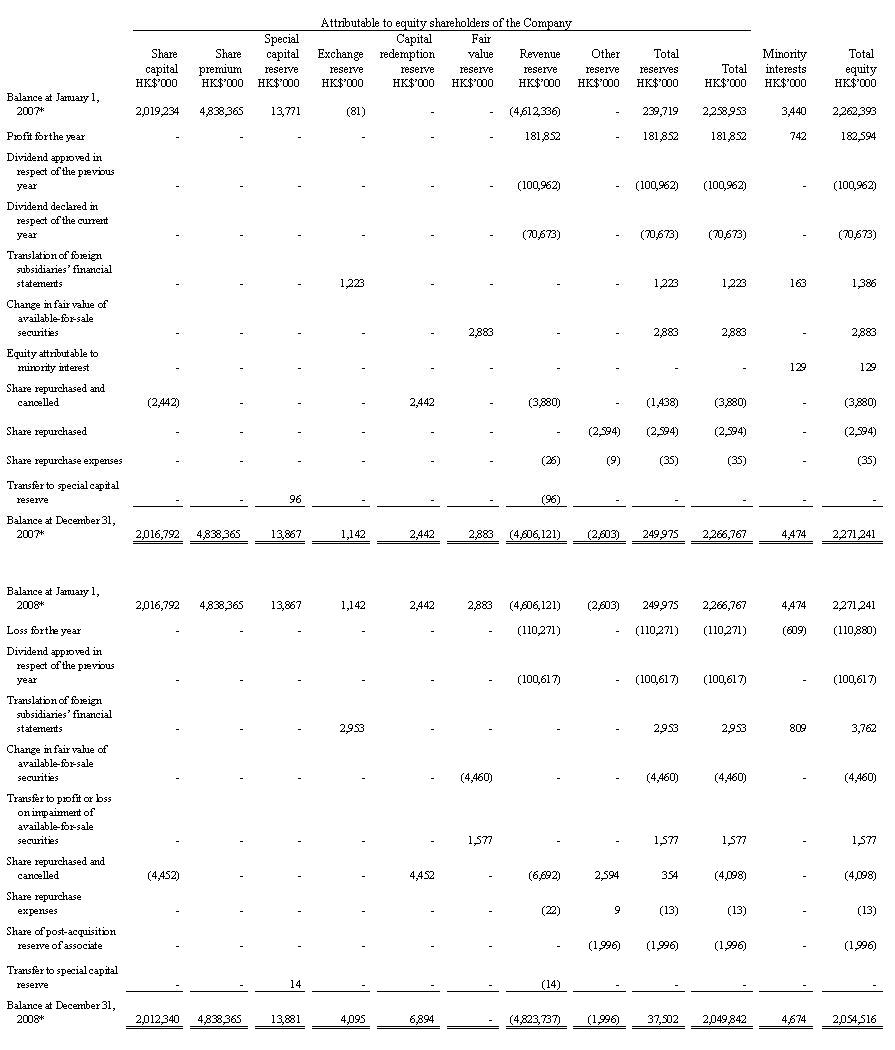

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the year ended December 31, 2008

* Included in the Group's revenue reserve is positive goodwill written off against reserves in prior years amounting to HK$197,785,000.

NOTES TO THE FINANCIAL STATEMENTS

(1) Basis of preparation

The financial statements for the year ended December 31, 2008 have been prepared in accordance with all applicable Hong Kong Financial Reporting Standards ("HKFRS") which collective term includes all applicable individual Hong Kong Financial Reporting Standards, Hong Kong Accounting Standards ("HKAS") and Interpretations issued by the Hong Kong Institute of Certified Public Accountants ("HKICPA"), accounting principles generally accepted in Hong Kong and the requirements of the Hong Kong Companies Ordinance. They also comply with the applicable disclosure provisions of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited.

(2) Turnover

Turnover comprises principally subscription and related fees for Pay TV and Internet services and Internet Protocol Point wholesale services. It also includes advertising income net of agency deductions, channel service and distribution fees, programme licensing income, film exhibition and distribution income, network maintenance income and other related income.

(3) Segment information

Substantially all of the activities of the Group are based in Hong Kong and below is an analysis of the Group's revenue and result by principal activities:

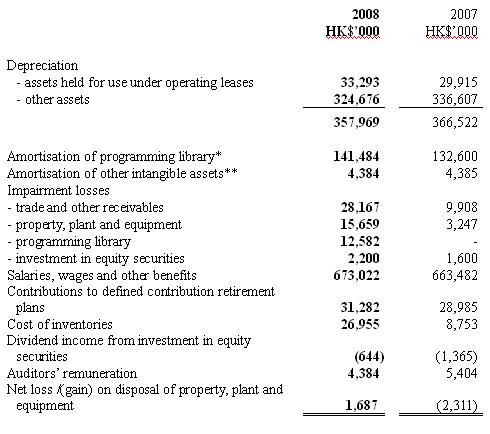

(4) (Loss)/profit before taxation

(Loss)/profit before taxation is stated after charging/(crediting):

*Amortisation of programming library is under programming costs in the consolidated results of the Group.

** Amortisation of other intangible assets is under network and other operating expenses in the consolidated results of the Group.

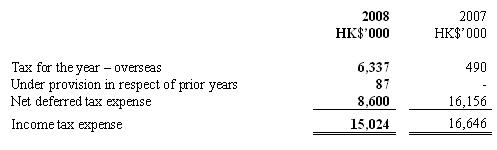

(5) Income tax

The provision for Hong Kong Profits Tax is calculated at 16.5% of the estimated assessable profits for the year (2007: 17.5%). Taxation for the overseas subsidiaries is charged at the appropriate current rate of taxation ruling in the relevant countries. The income tax charge for the year ended December 31 represents:

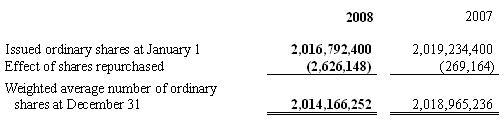

(6) (Loss)/earnings per share

The calculation of basic (loss)/earnings per share is based on the loss attributable to equity shareholders of the Company of HK$110 million (2007: profit of HK$182 million) and the weighted average number of ordinary shares outstanding during the year of 2,014,166,252 (2007: 2,018,965,236).

Weighted average number of ordinary shares

The calculation of diluted (loss)/earnings per share is based on the loss attributable to equity shareholders of the Company of HK$110 million (2007: profit of HK$182 million) and the weighted average number of ordinary shares of 2,014,166,252 (2007: 2,018,965,236) after adjusting for the effects of all dilutive potential ordinary shares.

All of the Company's share options did not have intrinsic value throughout 2007 and 2008. Accordingly, this has no dilutive effect on the calculation of dilutive earnings per share in both years.

(7) Accounts receivable from trade debtors

An ageing analysis of accounts receivable from trade debtors (net of allowance for doubtful debts) is set out as follows:

The Group has a defined credit policy. The general credit terms allowed range from 0 to 90 days.

(8) Amounts due to trade creditors

An ageing analysis of amounts due to trade creditors is set out as follows:

(9) Review of Financial statements

The financial results for the year ended December 31, 2008 have been reviewed with no disagreement by the Audit Committee of the Group. This preliminary results announcement has also been agreed with the Group's Auditors.

PURCHASE, SALE OR REDEMPTION OF SHARES

During the year, the Company repurchased on the Stock Exchange a total of 2,786,000 ordinary shares at an aggregate price of HK$4,102,068.

Save as disclosed above, neither the Company nor any of its subsidiaries has purchased, sold or redeemed any listed securities of the Company during the year under review.

BOOK CLOSURE

The Register of Members of the Company will be closed from Friday, May 29, 2009 to Wednesday, June 3, 2009, both days inclusive, to ascertain shareholders' rights for the purpose of attending and voting at the forthcoming Annual General Meeting ("AGM"). In order to ascertain shareholders' rights for the purpose of attending and voting at the forthcoming AGM, all transfers, accompanied by the relevant share certificates, must be lodged with the Company's Registrars, Tricor Tengis Limited, at 26th Floor, Tesbury Centre, 28 Queen's Road East, Wanchai, Hong Kong, not later than 4.30 p.m. on Wednesday, May 27, 2009.

By Order of the Board

Wilson W. S. Chan

Company Secretary

Hong Kong, March 13, 2009

As at the date of this announcement, the Board of Directors of the Company comprises Mr. Stephen T. H. Ng, Mr. William J. H. Kwan and Mr. Peter S. O. Mak, together with three independent non-executive Directors, namely, Dr. Dennis T. L. Sun, Mr. Patrick Y. W. Wu and Mr. Anthony K. K. Yeung.