|

August 12 , 2008 |

i-CABLE COMMUNICATIONS LIMITED

Stock Code: 1097

Interim Results Announcement

For the six months ended June 30, 2008Sound Financial Position & Low Cost Base Enable Investment to Compete

Results Highlights

- Turnover decreased by 10% to HK$1,069 million (2007: HK$1,185 million).

- Net profit before tax decreased by 63% to HK$44 million (2007: HK$119 million).

- A HK$15 million adjustment for deferred tax due to the reduction in the Hong Kong profits tax rate resulted in a quantum increase in the Group's income tax expense for the period.

- Net profit after tax decreased by 78% to HK$26 million (2007: HK$116 million).

- Net cash of HK$545 million as at June 30, 2008 (2007: HK$552 million).

- The Board has resolved not to declare any interim dividend for the six months ended June 30, 2008 (2007: interim dividend of HK$0.035 per share).

Pay TV

- Subscribers increased by 1% in the period to 892,000 (end of 2007: 882,000).

- Turnover decreased by 16% to HK$699 million (2007: HK$827 million).

- Operating profit decreased by 39% to HK$61 million (2007: HK$100 million).

Internet & Multimedia

- Broadband subscribers decreased by 9% in the period to 280,000 (end of 2007: 306,000).

- Turnover maintained at HK$295 million (2007: HK$295 million).

- Operating profit increased by 8% to HK$93 million (2007: HK$86 million).

GROUP RESULTS

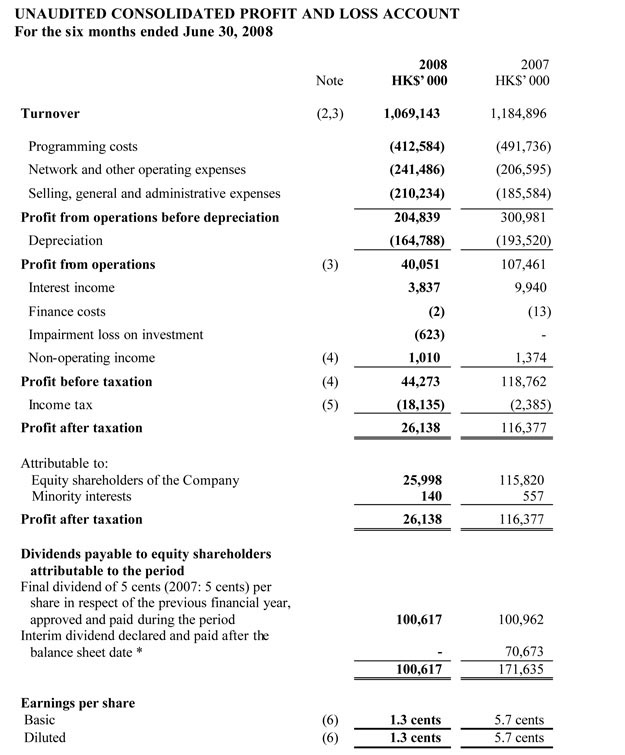

The unaudited Group profit attributable to Shareholders for the six months ended June 30, 2008 amounted to HK$26 million, as compared to HK$116 million for the corresponding period in 2007. Basic and diluted earnings per share were both HK$0.013 for 2008, as compared to both HK$0.057 last year.

INTERIM DIVIDENDThe Board has resolved not to declare any interim dividend for the six months ended June 30, 2008 (2007: interim dividend of HK$0.035 per share).

MANAGEMENT DISCUSSION AND ANALYSIS

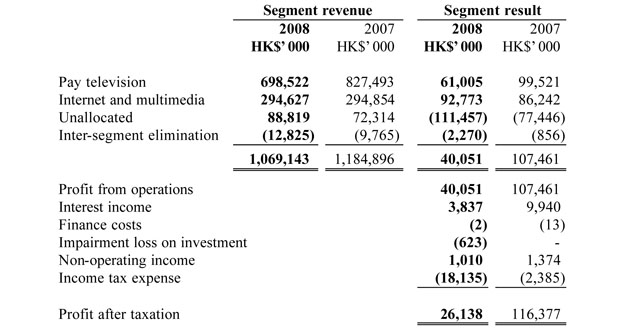

A. Review of 2008 Interim ResultsConsolidated turnover decreased by 10% to HK$1,069 million.

With effective cost management and resource re-allocation, operating costs before depreciation decreased by 2% to HK$864 million. Programming costs decreased by 16% but network and other operating costs increased by 17% and selling, general and administrative expenses increased by 13%.

Earnings before interest, tax, depreciation and amortisation ("EBITDA") decreased by 32% to HK$205 million.

Depreciation decreased by 15% to HK$165 million to follow the steady trend in recent years.

Profit from operations decreased by 63% to HK$40 million, while profit before tax decreased by 63% to HK$44 million.

A HK$15 million unfavourable adjustment of the opening balance for deferred tax was recognised due to the reduction in Hong Kong profits tax rate from 17.5% to 16.5%. This translated into an increase in the Group's income tax expense for the period.

Profit after tax decreased by 78% to HK$26 million.

Basic earnings per share were 1.3 cents as compared to 5.7 cents in 2007.

B. Segmental Information

Pay TelevisionSubscribers increased by 10,000 or 1% in the period to 892,000. However, turnover decreased by 16% to HK$699 million, mainly attributable to dilution from lower yield subscriptions. Operating costs after depreciation decreased by 12% to HK$638 million primarily due to the aforementioned decrease in programming costs and depreciation charge. Operating profit decreased by 39% to HK$61 million (2007: HK$100 million).

Internet & MultimediaBroadband subscribers decreased by 26,000 or 9% in the period to 280,000 and the Voice conveyance service decreased by 4% to 153,000 lines. Turnover was largely unchanged at HK$295 million. Operating costs after depreciation decreased by 3% to HK$202 million partly due to lower depreciation charges. Operating profit increased by 8% to HK$93 million.

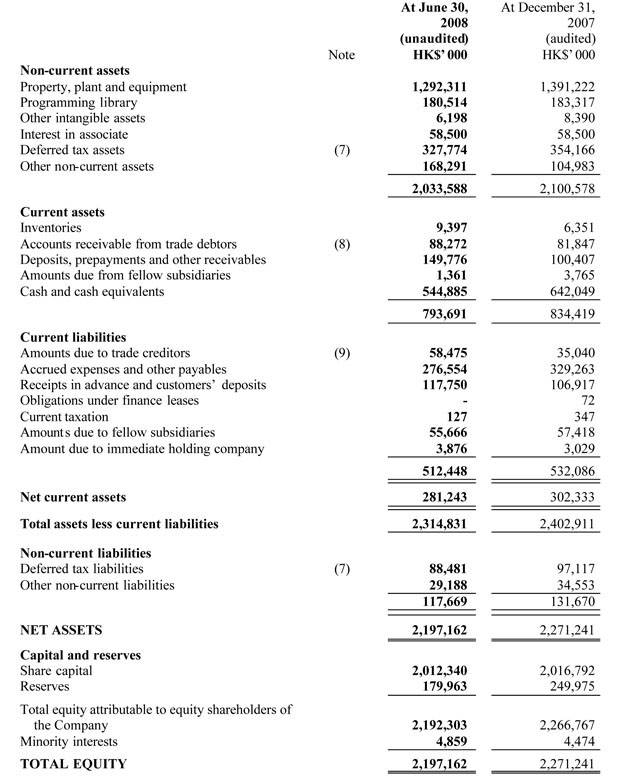

C. Liquidity and Financial ResourcesAs of June 30, 2008, the Group had net cash of HK$545 million, as compared to HK$552 million a year ago.

The consolidated net asset value of the Group as at June 30, 2008 was HK$2,197 million, or HK$1.1 per share. As at June 30, 2008, the Group had property, plant and equipment with a net book value of approximately HK$467,000 held under finance lease contract.

The Group's assets, liabilities, revenues and expenses were mainly denominated in Hong Kong dollars or U.S. dollars and the exchange rate between these two currencies has remained pegged.

Capital expenditure during the period amounted to HK$68 million, 4% lower than the same period last year. Major items included network upgrade and expansion, television production facilities as well as Internet & Multimedia equipment.

The Group's ongoing capital expenditure and new business development will be funded by cash to be generated from operations and, if needed, bank borrowings or other external sources of funds.The Group also had total short-term bank credit facilities of approximately HK$29 million which remained unutilised as of June 30, 2008.

D. Contingent LiabilitiesAt June 30, 2008, there were contingent liabilities in respect of guarantees, indemnities and letters of awareness given by the Company on behalf of subsidiaries relating to overdraft and guarantee facilities of banks up to HK$158 million, of which only HK$129 million have been utilised by the subsidiaries.

E. Human ResourcesThe Group had a total of 2,928 employees at the end of June 2008 (2007: 2,855). Total gross amount of salaries and related costs incurred in the corresponding period amounted to HK$379 million (2007: HK$359 million).

To support business growth and development in a competitive market, the Group is dedicated to continue our effort in attracting, retaining and developing employees of high quality with established pay for performance culture, linking remuneration and reward to Group performance as well as offering skill-based training and rewarding career advancement opportunities to them.

Being a caring employer, the Group continues to actively support community services and social welfare activities and to encourage our employees and their families to participate in volunteer services.

F. Operating Environment and CompetitionThe first half of the year saw the introduction of Digital Terrestrial Television service with coverage expanding to about 75% of households in Hong Kong at the end of June. The new service has not so far brought any major adverse impact to the Pay TV market and it remains to be seen if the Beijing Olympics could draw more converts with the free-to-air broadcasters boosting High Definition Olympic coverage.

Within the Pay TV market, competition remained intense but the Group grew its subscription base with enhanced programming and marketing packages. We have stocked up prized programming to sustain our competitiveness and will continue to invest in programming and promotion.

Service quality and bundled packages with Pay TV and Voice services were again the main competitive tools for Broadband. This core business remained steady both in terms of subscription and profitability.

The operating environment in the near term is not expected to improve. In a war of attrition, the Group will benefit from its strong balance sheet and its significantly lower cost base for both fixed assets and operating expenditures.

G. OutlookRapidly changing market conditions call for business and programming diversification in order to break new grounds and for streamlining operations to enhance efficiency - an exercise the Group has undertaken over the past years. It also calls for investing to compete and the Group's strong financial position and low cost base place it very well to do so.

We have scaled up local production; bagged nearly all top sports events until 2012; sharpened our marketing and customer service operations; and diversified our business by making prudent ventures into new markets such as movie and music production, publications and the new media.

Furthermore, we have committed to introducing the next generation transmission encryption system in order to better protect and grow our Pay TV service, while at the same time, allowing deployment of high definition television and interactive services when the market is ripe.

These steps are necessary to propel us forward and to prevail over the competition.

CODE ON CORPORATE GOVERNANCE PRACTICESDuring the financial period under review, all the code provisions set out in the Code on Corporate Governance Practices contained in Appendix 14 of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited were met by the Company, except in respect of one code provision providing for the roles of chairman and chief executive officer to be performed by different individuals. The deviation is deemed necessary as, given the nature and size of the Company's business, it is at this stage considered to be more efficient to have one single person to hold both positions. The Board of Directors believes that the balance of power and authority is adequately ensured by the operations of the Board which comprises experienced and high calibre individuals with a substantial proportion thereof being independent Non-executive Directors.

UNAUDITED CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the six months ended June 30, 2008

* The interim dividend proposed after the balance sheet date has not been recognised as liability at the balance sheet date.

CONSOLIDATED BALANCE SHEET

At June 30, 2008

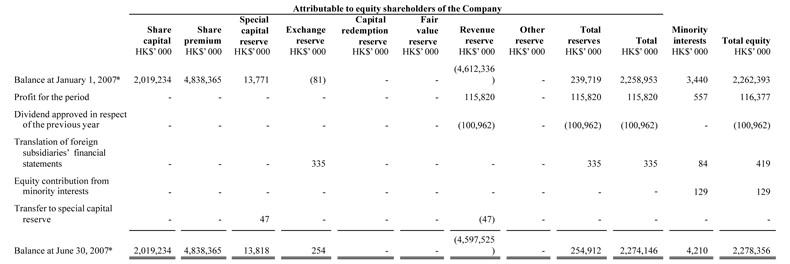

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended June 30, 2008

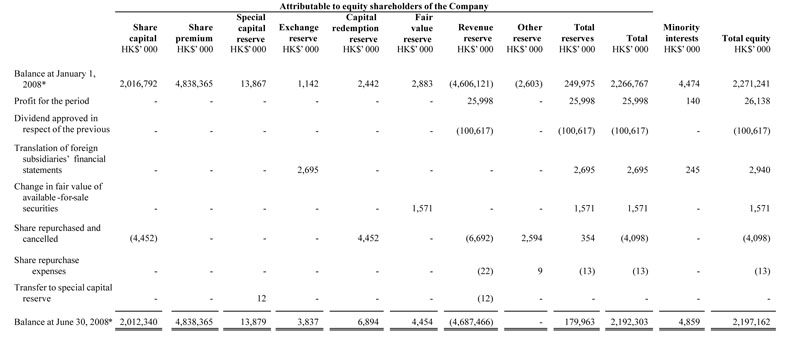

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended June 30, 2008

* Included in the Group's revenue reserve is positive goodwill written off against reserves in prior years amounting to HK$197,785,000.

** The special capital reserve is non-distributable and it should be applied for the same purposes as the share premium account.

NOTES TO THE INTERIM FINANCIAL REPORT

(1) Basis of preparation and comparative figuresThe unaudited interim financial report has been prepared in accordance with the requirements of the Main Board Listing Rules of The Stock Exchange of Hong Kong Limited, including compliance with Hong Kong Accounting Standard 34 "Interim financial reporting" issued by the Hong Kong Institute of Certified Public Accountants ("HKICPA").

The HKICPA has issued certain new and revised Hong Kong Financial Reporting Standards ("HKFRSs") that are first effective or available for early adoption for the current accounting periods of the Group. We believe the adoption of these new and revised HKFRSs will not have a material impact on the Group's financial position or results of operations.

The same accounting policies adopted in the annual financial statements for the year ended December 31, 2007 have been applied to the interim financial report.

(2) TurnoverTurnover comprises principally subscription and related fees for Pay television and Internet access services, Internet Protocol Point wholesale service income and also includes advertising income net of agency deductions, channel service and distribution fees, programme licensing income, film exhibition and distribution income, network maintenance income, and other related income.

(3) Segment information

Substantially all the activities of the Group are based in Hong Kong and below is an analysis of the Group's revenue and result by principal activity for the six months ended June 30:

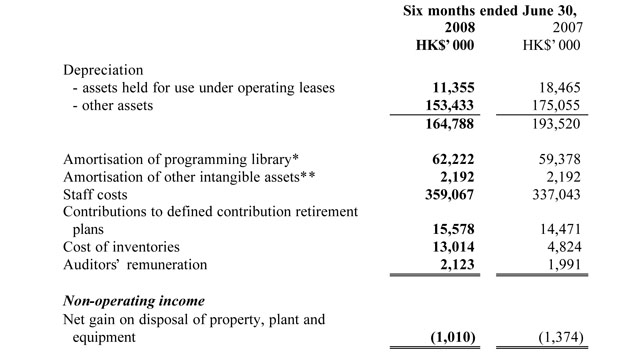

(4) Profit before taxationProfit before taxation is stated after charging / (crediting):

* Amortisation of programming library is included within programming costs in the consolidated results of the Group.** Amortisation of other intangible assets is included within network and other operating expenses in the consolidated results of the Group.

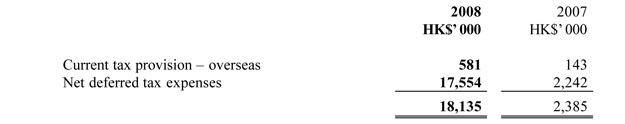

(5) Income taxThe provision for Hong Kong Profits Tax is calculated at 16.5% (2007: 17.5%) of the estimated assessable profits for the period. Taxation for the overseas subsidiaries is charged at the appropriate current rate of taxation ruling in the relevant countries. The income tax charge for the six months ended June 30 represents:

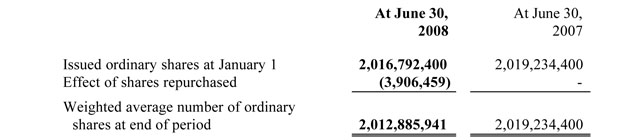

(6) Earnings per shareThe calculation of basic earnings per share is based on the profit attributable to equity shareholders of the Company of HK$26 million (2007: HK$116 million) and the weighted average number of ordinary shares outstanding during the period of 2,012,885,941 (2007: 2,019,234,400).

(i) Weighted average number of ordinary shares

The calculation of diluted earnings per share is based on the weighted average number of ordinary shares of 2,012,885,941 (2007: 2,019,234,400) after adjusting for the effects of all dilutive potential ordinary shares.

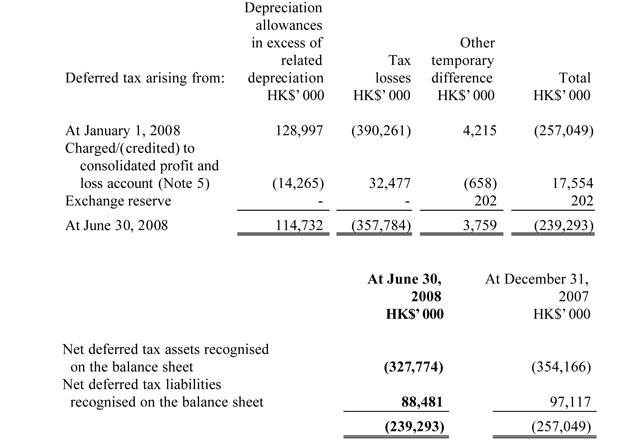

(7) Deferred tax in the balance sheetThe components of deferred tax (assets)/liabilities recognised in the consolidated balance sheet and the movements during the period are as follows:

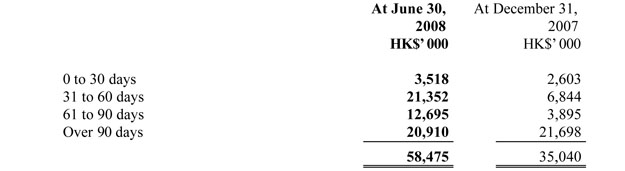

(8) Accounts receivable from trade debtorsAn ageing analysis of accounts receivable from trade debtors (net of impairment losses for bad and doubtful accounts) is set out as follows:

The Group has a defined credit policy. The general credit terms allowed range from 0 to 90 days.

(9) Amounts due to trade creditorsAn ageing analysis of amounts due to trade creditors is set out as follows:

(10) Review of resultsThe unaudited interim financial report for the six months ended June 30, 2008 has been reviewed with no disagreement by the Audit Committee of the Company.

PURCHASE, SALE OR REDEMPTION OF SHARESDuring the financial period under review, the Company repurchased on The Stock Exchange of Hong Kong Limited a total of 2,786,000 ordinary shares at an aggregate price of HK$4,110,397. Save as disclosed above, neither the Company nor any of its subsidiaries has purchased, sold or redeemed any listed securities of the Company during the year under review.

By Order of the Board

Wilson W. S. Chan

Secretary

Hong Kong, August 12, 2008

As at the date of this announcement, the Board of Directors of the Company comprises Mr. Stephen T. H. Ng, Mr. William J. H. Kwan and Mr. Peter S. O. Mak, together with three independent non-executive Directors, namely, Dr. Dennis T. L. Sun, Mr. Patrick Y. W. Wu and Mr. Anthony K. K. Yeung.

- End -